Did you know SHIFT is taking the stage on Sept 30 and Oct 1? Together with an amazing line-up of experts, we will explore the future of mobility during TNW Conference 2021. Secure your ticket now!

Swedish electric car maker Polestaris the latest company planning a deal to go public through a special purpose acquisition company (SPAC). A deal with Gores Guggenheim Inc will raise a whopping $20 billion. As a result, Polestar gains three times its projected revenues for 2023.

Some history and context. Polestar is jointly owned by Volvo Cars and Chinese auto company Geely. Following the success of the Polestar 1 and 2 EVs, the company raised in April $550 million in external funding and plans to build the Polestar 3 SUV at Volvo’s U.S. plant, in the second half of 2022.

The also company plans to launch two additional new models by 2024, and expand its global distribution footprint to 30 markets by 2023.

Okay, so what’s a SPAC?

A special purpose acquisition company (SPAC) is a shell company formed explicitly to raise money through an IPO, in order to acquire an existing company. Investors also call them “blank check companies.”

(FYI: An IPO is an initial public offering where a company offers shares for the first time to raise money from public investors.)

A SPAC provides no commercial operations. They make no products and sell nothing. A SPAC typically has two years to complete an acquisition, or they must return their funds to investors.

SPACs are generally formed by investors focused or experienced with a particular sector who are closely knowledgeable about trends and tech.

What’s the big deal?

SPACs have grown in popularity over the last few years. According to Pitchbook, Q1 2021 saw 325 SPAC deals issued, compared to 276 deals in 2020 and 83 in 2019.

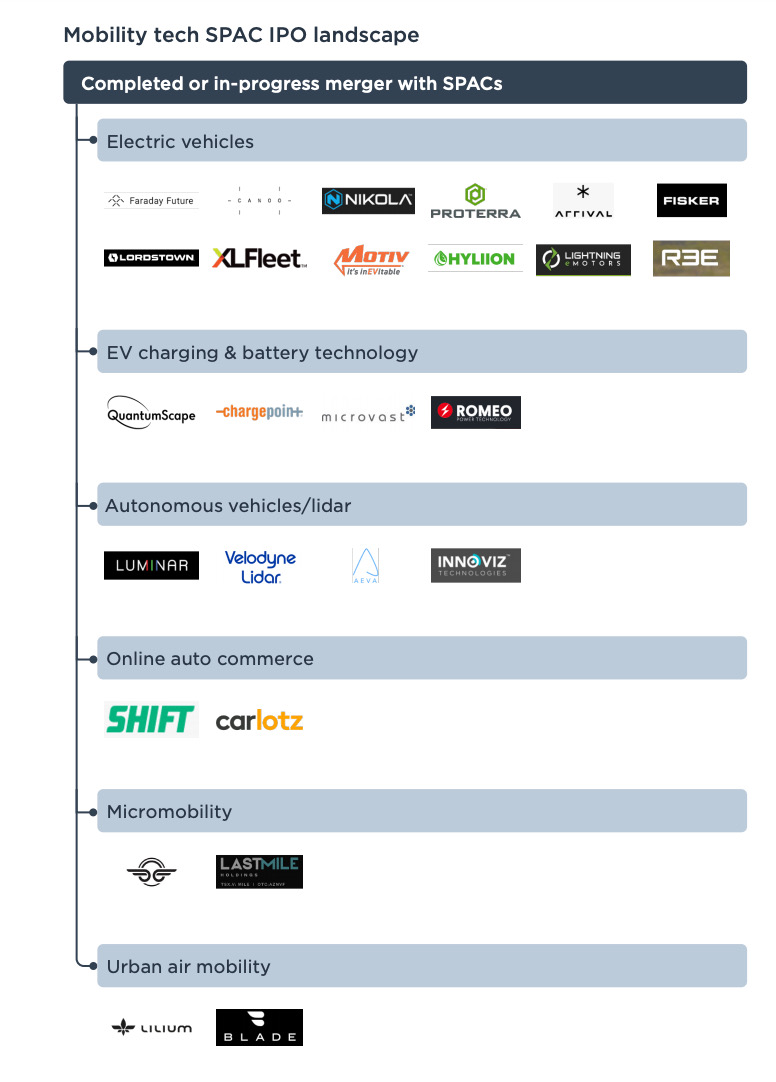

And a lot of these deals have been taking place in the mobility industry.

2020 saw over 26 mobility companies merge with SPACS, including Virgin Galactic, and Nikola Motor Co. Some other big players were LiDAR companies: Aeva, Innoviz, Luminar, Ouster, and Velodyne AEye. This year has also seen numerous SPACS not only by Polestar, but also by eVTOL companies like Archer aviation, Joby, and Lilium, and battery recycler Li-Cycle.

What are the advantages of a SPAC?

In short, SPACs are a faster way for late-stage mobility companies to access public markets. That way, they can raise more money than with traditional VC or investor fundraising.

Plus, SPACs are less scrutinized in terms of financial reporting and investor analysis than traditional IPOs. According to Crestbridge, selling to a SPAC can add up to 20% to the sale price compared to a typical private equity deal.

What are the downsides to a SPAC?

But it’s not all good news. Senior analysts at Pitchbook, Asad Hussain and Cameron Stanfill, did a comprehensive Pitchbook of mobility SPACs.

They note that companies can be over-hyped and receive heavy investment without scrutiny. For example, battery tech company QuantumScape obtained a valuation of $19.3 billion. This was despite not being expected to generate any meaningful revenue until 2025.

Hydrogen trucking company Nikolahas maintained a valuation of more than $6.5 billion, despite multiple allegations of fraud and misleading SPAC investors. The company is under investigation by the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice.

Hussain and Stanfill note:

While we are optimistic about electric vehicle adoption in the long term, we believe a major stock price decline in a high-profile name such as Tesla or Nikola could translate to a pullback in the broader electric vehicle and mobility SPAC ecosystem.

Baris Guzel, Partner at BMWiVentures, keeps a running spreadsheet of mobility SPACs. He asserts on Medium that:

Due to substantial economics, SPACs are attracting unusual sponsors with limited investment experience, such as celebrities and politicians, which could create an “ICO like” environment and hurt the reputation of SPACs as a class.

Urgh, remember ICOs?

SPACs highlight the challenge of mobility fundraising

Fundraising is not always easy without a product. Especially if you’re operating in stealth mode. Many companies provide not much more than a CGI video simulation of their finished product, and a model which may not even be functional or life-sized.

But you could also concede that the absence of an actual product has never stopped investors from putting up money in companies before.

What the vast majority of mobility companies do possess is credibility. Most founders come from within the industry. There’s a lot of companies that are university spinoffs or employ highly knowledgeable academics.

But they’re dealing with products that could end up dead if poorly handled on the road or in the sky. It’s understandable that they are slow burners rather than fast to market.

Companies are forming partnerships and alliances and convergence (especially in battery tech). Thus, the hope of a great return on investment (ROI) remains the goal of savvy investors.

Do EVs excite your electrons? Do ebikes get your wheels spinning? Do self-driving cars get you all charged up?

Then you need the weekly SHIFT newsletter in your life. Click here to sign up.

Get the TNW newsletter

Get the most important tech news in your inbox each week.