Working as a tech journo, I meet many people with big, world-changing ideas. But despite the hyperbole, when I ask about how they are going to achieve their aims – or indeed if they are already up and running, who they have helped – the Zoom call often gets really quiet.

So when I meet someone who is making the lives of some of the most disadvantaged people in the world a better place, and they’re using tech to do so, I get wildly excited.

This week I had the pleasure of talking to Michael Schlein, President, and CEO at Accion.

Accion is a global nonprofit committed to creating a financially inclusive world. As Schlein explained, “We are dedicated to enabling 3 billion people who are left out of – or poorly served by – the financial sector to improve their lives.”

Accion has been around for over 60 years with a legacy in microfinance and fintech impact investing. In other words, they invest in companies and services that provide financial services, especially to those who may have been unbanked, and unable to access microloans, or insurance. Accion works to advance its mission in many ways, including the sponsorship of two global venture investment funds, and a think tank on financial inclusion.

Serving and uplifting disadvantaged communities with fintech

Critically, Schlein explained, the investment companies not only serve disadvantaged and minority communities but represent them at a local level.

This is encouraging. According to Harvard Business Review, in 2019, 2.8% of funding went to women-led startups; in 2020, that fell to 2.3%, Crunchbase figures show.

Even worse, the 2.8% figure was an all-time high. Then, within this funding, even less traditionally goes to Black and Latino women, or those without university degrees.

According to Schlein, Accion is most often the first funder of financial companies helping the poor after family and friends.

Schlein shared that the company’s investment in women-led financial services has a flow-on effect where women invest in women-led businesses, which build profits and good financial health.

This not only benefits themselves and their families but their wider communities.

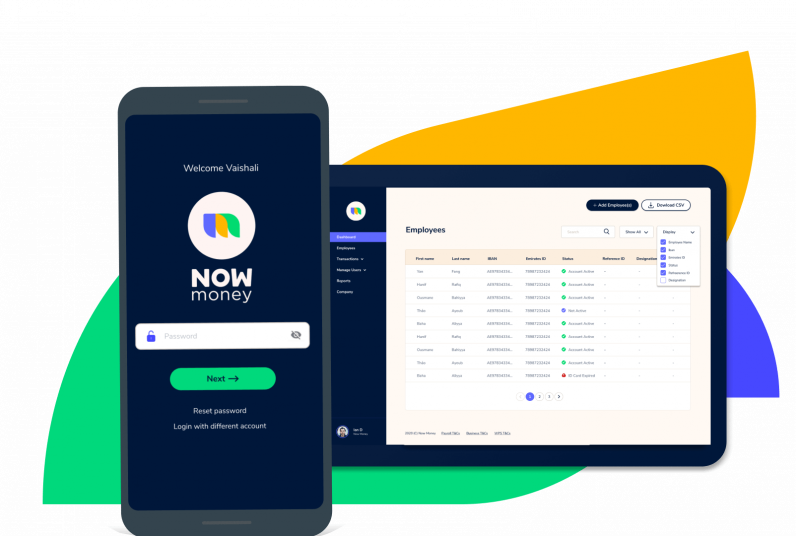

A great example of a business serving the underserved is NOW Money. The company helps employers of migrant laborers in the United Arab Emirates to provide payroll services.

Instead of simply distributing cash cards, NOW Money provides workers with a bank account, debit card, and smartphone application. From these they can make local payments, international remittances, and cash withdrawals at local ATMs.

COVID-19 bought digitization of critical services to the forefront

The pandemic created a perfect storm for the rapid acceleration of digital transformation. Many companies focused on remote healthcare. But Accion saw the inequality experienced by the poor accessing services, such as business loans and insurance.

Many mainstream providers are reluctant to serve the poor, making it hard for people to gain financial security. This created an opportunity for fintech startups and investors to make a difference.

Fintech platforms can help small businesses pivot

Covid-19 also created the need for new business models. An example of this is Goodfynd, an app and financial services platform in the US that helps people start and develop profitable food trucks.

Food trucks are much cheaper to launch than brick-and-mortar restaurants. This makes them attractive to people outside of conventional hospitality. They represent all genders and races and don’t require a university degree or fluent English.

COVID saw many restaurants limit their seating, creating an opportunity for many trucks to expand their business. But people running food trucks also need to be on top of keeping themselves safe. They also need to position their trucks to suit the stay-at-home audience.

So, Goodfynd helps customers find food trucks through an app. In turn, the businesses can use the platform to find staff and gain the essential financial knowledge and tools to thrive. Very cool.

Maybe you’re the founder or CEO of a fintech startup looking to create products that radically change the finance sector? Accion can provide a myriad of ways to create and deliver services to the underserved that are not only beneficial but can be highly profitable.

This is an incredibly exciting area of business where out-of-the-box ideas, good intentions, and great tech can merge to create great things.

Did you know Michael Schlein, President, and CEO at Accion, is speaking at the TNW Conference this summer? Check out the full list of speakers here.

Get the TNW newsletter

Get the most important tech news in your inbox each week.