Dozens of pitch decks rush into investors’ mailboxes daily. If you ask what the founders usually emphasize, it’s — unsurprisingly — a “we’re disrupting the market” claim.

Sure, a founder must believe in the product. However, it’s not about unique technology but more about convincing customers that their old pattern is less convenient. That is easy enough to do at the later stages with the positive unit economy in hand.

But what about early-stage startups that cannot yet demonstrate digitized metrics?

Traction at early stages

Typically, traction includes the following metrics:

- ARPPU (average revenue per paying user)

- DAU or MAU (total number of daily or monthly active users)

- MRR (monthly revenue and monthly recurring revenue) dynamics

- Dynamics of contract sales (bookings)

This data is essential but not always relevant to the project at an early stage. Therefore, consider adding the following metrics crucial for investors to your pitch:

- The startup’s depth of knowledge of the audience and its pain points

- Confirmation of the value provided

Here is how you can digitize these metrics:

1. Letters of guarantee or partnership agreements

This is primarily relevant for the B2B sector, but getting these letters conveys the industry’s interest in the project and demonstrates that the market trusts the startup.

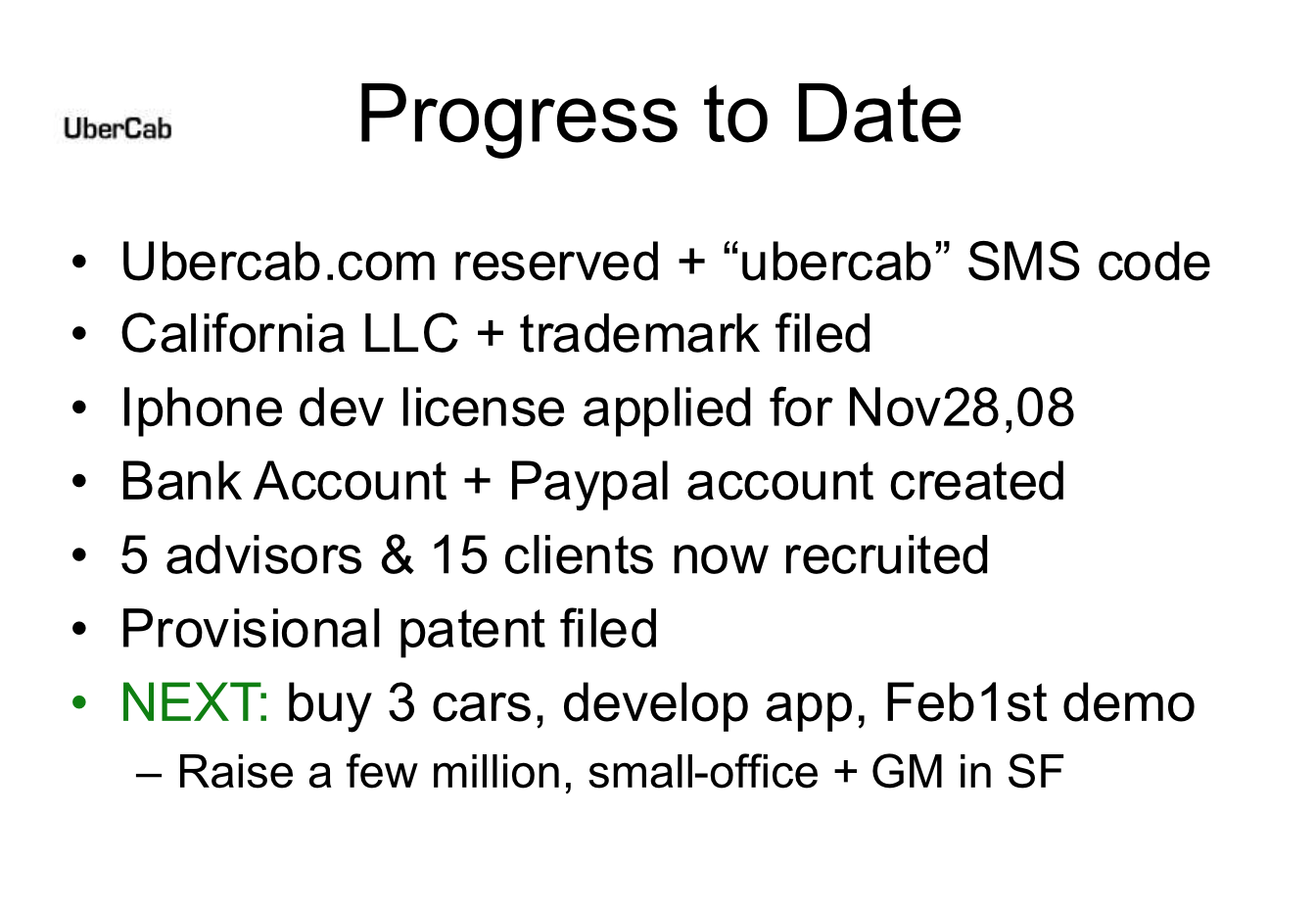

For instance, in its first pitch deck in 2008 presenting its new business model, Uber included traction like five advisors and 15 clients interested in the product. Apparently, it worked!

2. CustDev results

The research should vindicate the wow effect the product is having on consumers. You don’t have to rely on skimpy social-demographic data or survey results. Find a creative approach to the task.

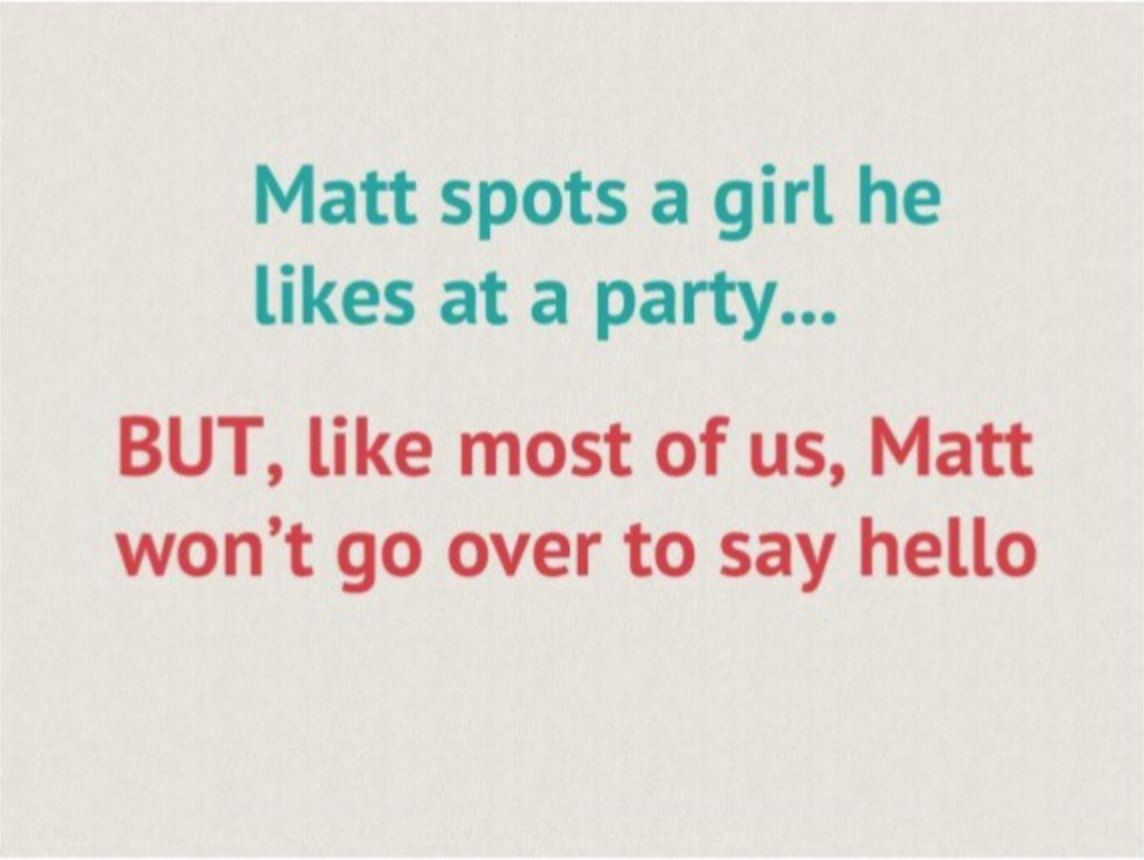

You can for example express your client’s pain through storytelling to put an investor in the user’s shoes. Tinder used this technique in its first pitches when the company was still called MatchBox.

The service’s founders told the story of Matt, who saw a girl at a party but, like many guys, was afraid of possible rejection and did not dare to get acquainted with her. The app helped overcome the fear. Matt ended up finding a girl through the MatchBox app, which allows you to strike a conversation with someone only if you like each other.

Tinder’s example is notable because instead of just talking about the solution, the founders tell the story of a customer’s journey, emphasizing the highlights with screenshots.

3. The immediate value confirmation of a product

By doing this, you can determine if clients are ready to get on board here and now. In addition, it is possible to build a hypothesis about the demand when the product integrates fully in a highly competitive market. Take Educate Online as an example.

The startup developed an online platform through which students can learn online in the best international schools. Educational institutions saw the potential of the platform even before the pandemic.

In late 2018, a Florida school offered to collaborate. Thanks to this, by the beginning of the COVID-19 crisis, the startup had already managed to test the new format. It was ready for the mass transition to online tuition better than its competitors.

Thus, as we can see from these three examples, for an investor who assesses a product’s disruptive potential, a startup’s performance in the early stages is secondary.

To substantiate the project’s market-shaking potential, the founders must demonstrate a profound comprehension of its customers and its pains and get the audience to confirm its value.

Get the TNW newsletter

Get the most important tech news in your inbox each week.