Update (February 9, 2022, 11.30AM IST): Last night, Apple officially launched its “Tap to pay” feature that’ll let you turn your iPhones into payment terminals. While the company didn’t specify a roll-out date, it said it’ll be available to merchants across the US with a software update.

The Cupertino-based company said to use this feature, you’ll have to have an iPhone XS or a later model. The company has already started testing the feature with developers in iOS 15.4 beta, but we don’t know how much functionality is available at the moment.

Notably, this feature will be powered by partner apps and APIs. At its launch, Shopify will provide a point of sale app, and Stripe will power the payment processing through its SDKs (Software Development Kit). Apple said that more payment platforms and apps will follow this year.

That means payment processors, such as Square or Venmo, will be able to take advantage of this feature through their existing network.

The new tap-to-pay feature indicates Apple is not trying to be a payment processor just yet. It might have a backroom deal with its partners to get some royalty on the transaction, but we wouldn’t know.

After its introduction in 2014, Apple Pay has made spending seamless for swathes of people. Now, the company wants to move to the other side of the aisle. This time, to accept payments.

Last week, Bloomberg reported that Apple is planning to introduce a new feature in the coming months that will let merchants accept card payments directly through their iPhones. In short, it wants to make its device a payment terminal or a point of sale (POS) machine.

How will it work?

The report noted that this feature will be part of a software update in the coming months. So if you’re a merchant, you won’t have to go through a lot of steps to set it up.

In 2020, Apple acquired Canada-based payments startup Mobeeweave, which enabled mobile phones to act as payment terminals. Before this acquisition, the startup worked with Samsung to turn the Korean tech giant’s NFC-enabled phones into POS machines. Apple’s upcoming feature is expected to work in the same way.

However, there are a lot of unknowns about the product at this moment: will it be under the Apple Pay umbrella? Will Apple use the existing payment processing network or create its own?

Taking on Square and Venmo

Square is one of the biggest companies in North America when it comes to POS machines. The company sends merchants a free magstripe card reader, and charges just $49 for a contactless one.

However, Apple can one-up them by removing any hardware constraint, and letting merchants just use their phones. Plus, it can make people using Android phones a customer.

Kevin Susman, VP Brand & Communications at MATRIXX Software, a company that works with carriers for monetization, said this new feature can help Apple get into a wider peer-to-peer payment space, where companies like Venmo operate. He also said Apple Cash’s adoption spread is questionable:

Of course, much of this is a result of the fact that it is not cross-platform — you can’t send Apple Cash to an Android user. But, as relates to payments, you can pay with ApplePay (and Apple Cash), but you (merchants) can’t charge with it.

Making it possible to do so means that you can support SMB’s for sure, but you can also support peer-peer charging, similar to Venmo’s.

Notably, Apple already lets you send money to your friends registered on the Apple Pay network without any charges. But iPhones-as-payment-terminals could be a whole different ball game.

Square offers basic inventory management and analytics features to its 64 million-plus merchants. While Apple has the power to turn millions of iPhones into cash registers, it’ll be important to see the suite of support software and commission fee it’ll offer.

Jephtah Chidozie Uche, a co-founder and CTO of Kippa, a bookkeeping startup based out Niegra, said Apple should provide APIs for developers so that service-provider apps can easily integrate this new feature. He mentioned that as iPhones are costly in many parts of the world, the company should also focus on having backward compatibility for cheaper and older devices.

The Cupertino giant doesn’t disclose what it earns from Apple Pay, but reports indicate it takes a 0.15% commission on transactions processed through Apple Pay. The company’s payment-accepting feature can add a significant revenue stream.

Shahaf Bar-Geffen, CEO of Israel-based fintech company COTI, said Apple wants to build believes Apple wants to create a public habit of using its payments services:

Apple is building a convenience system for now. It has already established one ease-of-payment method when you pay with your phone or a watch at a shop. To build trust in merchants to become a payment facilitator, it might charge no or negligible fee to make their iPhones a payment terminal. Or it might adapt a model where the fee is based on the volume of transactions.

Opportunity in the payment space

According to a report published by UK-based Juniper Research, there will be more than 4.4 billion mobile wallets across the world by 2025. However, 69% of transactions will be based in mobile payments heavy markets such as India and China. Apple would want to own a big chunk of that market in the rest of the world — especially in North America.

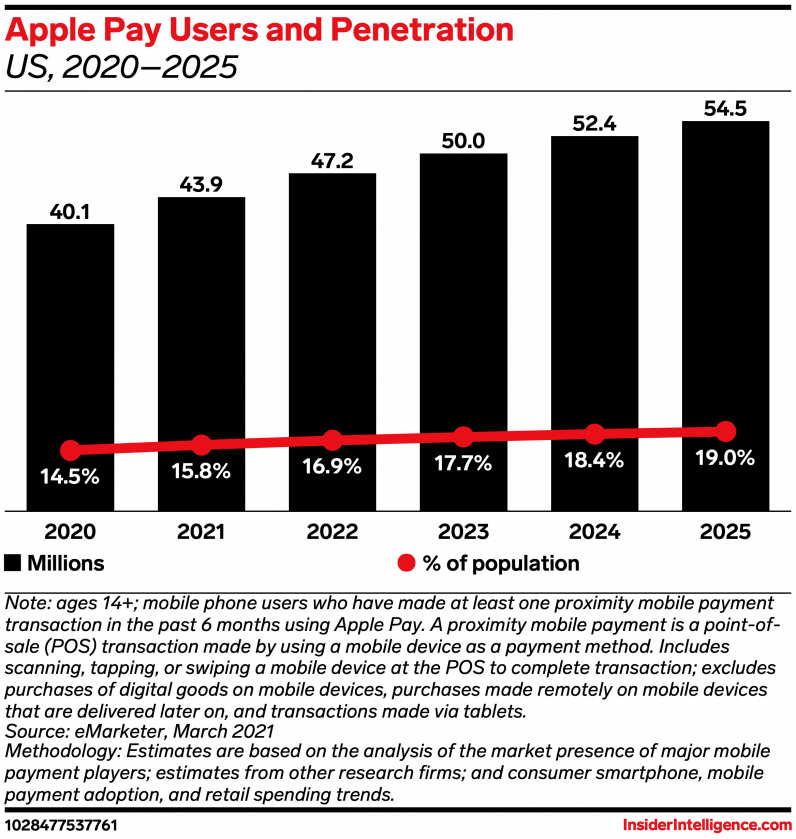

In 2020, Loup Ventures said more than 500 million customers had activated Apple Pay on their iPhones, but there’s no number to verify if those people ever made any payments. According to Insider Intelligence, there are more than 43 active million Apple Pay users in the US, and the company will add more than 11 million to that figure in the next four years.

The report notes that the US in-person payments market will expectedly hit the $6.4 trillion mark this year— and that’s a good sign for first-time entrants like Apple.

A survey conducted by fintech site PYMNT last year indicated that more than 65% of US consumers prefer to pay by credit or debit card in physical stores; Apple Pay’s share in that was just 2.6%. Apple turning iPhones into terminals is a surefire way to boost its visibility and traction in the space.

Over the last few years, Apple has been focused on expanding its services business — especially financial offerings. In 2019, it launched the Apple Card, and plans to expand it to more countries. Last July, a Bloomberg report noted that the company is exploring a “buy now, pay later” product with Goldman Sachs.

If Apple starts accepting payment on a seller’s behalf, it can explore more financial products, ranging from loans to management services. Really, this news shows how serious Apple is about getting its services to reach a $1.5 trillion valuation alone. And, at this stage, who would bet against it?

Get the TNW newsletter

Get the most important tech news in your inbox each week.