Ripple (XRP) is still arguably the most polarizing digital asset in the cryptocurrency space.

Powered by a network of less than 100 validators, Ripple Labs pitches XRP as a liquidity tool for the traditional finance sector. Its supporters fervently believe adoption is coming, while critics have long claimed that regulators may one day classify XRP as a security.

[READ: XRP bag holders are begging Ripple to stop dumping its coins]

Still, quarter after quarter, Ripple Labs sells millions of dollars worth of XRP to investors. This quarter saw the firm earn $13.08 million by selling XRP, down from $66.24 million in the previous three months.

XRP/USD 2019 Q3 performance recap

Ripple, like Bitcoin, declined in value for most of 2019’s third quarter. XRP opened July trade at just above $0.41, but would fall more than 40 percent to hit $0.24 by the end of September.

Swing traders were practically without luck. Aside from a handful of ineffectual bounces, the price of XRP was more often than not in the red.

Even the most obvious bounce, which occurred mid-September, didn’t leave speculators with loads of opportunity. That event only pushed XRP’s price up roughly 16 percent, with any momentum generated unfortunately short-lived.

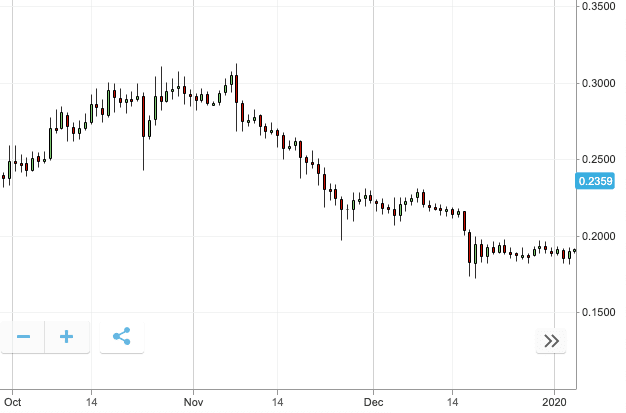

XRP/USD 2019 Q4 review

2019’s fourth quarter gave traders a little more room to breathe, with market performance generally split in half.

From October 1, XRP’s price gradually rose from $0.257 to just reach $0.30 on November 6. This would however mark its high for the quarter, with XRP retracing more than 35 percent to end the year’s trade at $0.194.

Those who opened longs at the start of October would’ve done well to get out before mid-November. In fact, market bounces were incredibly shallow for the rest of the year, which rendered swing trading relatively ineffectual.

At most, traders who bought XRP at the very start of the quarter could’ve made around 20 percent had they bought XRP at the very start of the quarter and sold the $0.30 top.

Biggest news for XRP in Q4 2019

Last quarter saw Ripple Labs (the company behind XRP) complete its acquisition of a $50 million stake in MoneyGram, a US-based money transfer firm, one of the largest in the world.

This means Ripple now owns a little less than 10 percent of MoneyGram’s outstanding common stock.

The firm also invested $750,000 into mobile wallet provider BRD through its investment arm Xpring. The deal aims to support a new strategic partnership between the two companies, with XRP added to the app so that users can hold, buy, sell, and send the cryptocurrency.

Aside from investments, Ripple continued to deal with an ongoing class action lawsuit that alleges it illegally sold unregistered securities in the form of XRP cryptocurrency.

The adoption of XRP cryptocurrency by the internet’s cyberbaddies also reportedly grew, with cryptocurrency analysis firm Elliptic providing evidence of $400 million in illicit XRP transactions.

Looking ahead

Ripple’s year-to-date market performance has been pretty strong. Backed by a resilient Bitcoin, the price of XRP is up almost 24 percent this year, rising gradually from $0.19 to $0.235 at pixel time.

It’s unlikely that these gains would continue without Bitcoin also moving upwards, so speculators would be wise to keep an eye out on sudden short-term downtrends in more dominant markets.

On the horizon, Ripple Labs CEO Brad Garlinghouse teased the company’s IPO plans, noting that he didn’t want to be the first or the last cryptocurrency company to go public.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Past performance is not an indication of future results. This is not investment advice. Your capital is at risk.