This article was written by Augustin Friedel, Smart Mobility Expert onThe Urban Mobility Daily, the content site of the Urban Mobility Company, a Paris-based company which is moving the business of mobility forward through physical and virtual events and services. Join their community of 10K+ global mobility professionals by signing up for the Urban Mobility Weekly newsletter. Read the original article here and follow them on Linkedin and Twitter.

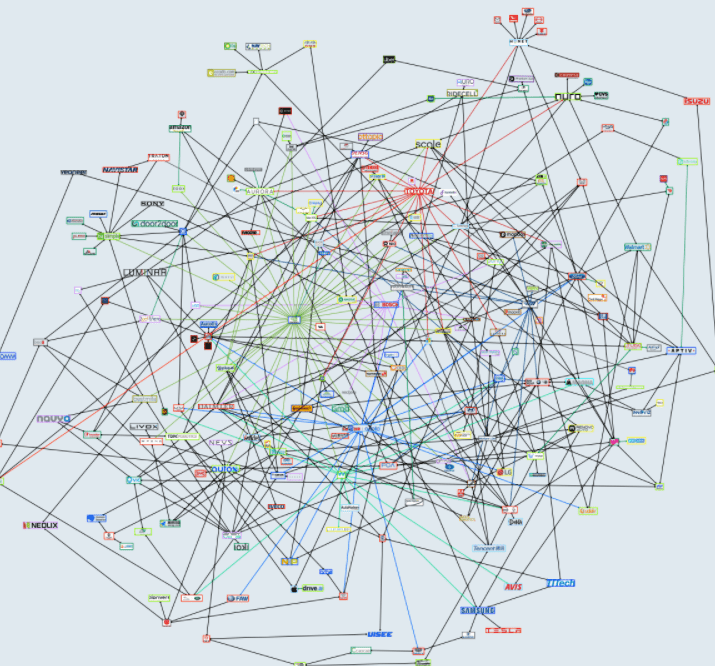

Moving closer to operational setups across the world, here is the latest update of the global Autonomous Driving Network, showcasing most of the disclosed partnerships, collaborations and investments on the path to autonomous vehicles.

Increased investment and partnership activities

If you have a look on the investment side, the autonomous driving space is seeing increased funding activities again after the first hype phase between 2016 and 2018. Since 2020, the investments in the self-driving ecosystem are seeing a steep upwards trend again according to a recent McKinsey study.

Investors have poured more than USD 105 billion into the autonomous driving tech landscape, roughly 51% was going into semiconductors/computing, followed by 33% for ADAS components. The remaining 15% were spread across simulation and mapping, autonomous vehicle integrations and software.

The investments in the industry are driven by no-automotive stakeholders. Most financing rounds since the start of 2021 came from venture capitalists, followed by tech companies from the hardware and software space and only 7% by Automotive incumbents.

SPACs and IPOs on the rise

The last quarter was characterized by big deals and the first IPO by a company working on a full self-driving tech stack. TuSimple, a well-funded startup with presences in the US and China announced in the first quarter 2021 to go public on the Nasdaq via a traditional IPO.

Talking about going public, many LiDAR companies were using the SPAC route to go public. Luminar, AEVA, OUSTER, AEYE; Velodyne LiDAR and INNOVIZ either announced a merger with a listed shell company or are already trading on the stock market.

Cruise with strong tailwinds

Focusing on partnerships and acquisitions, Cruise is continuing to make headlines on multiple fronts. The company, formed by General Motors, is seeing more and more interest from external investors and partners. In the latest funding round of USD 2.75 billion, Microsoft and Walmart participated with significant tickets. Microsoft is placing itself as a partner for software development and especially cloud solutions. Walmart is seeing potential in autonomous delivery and trucking. Cruise also acquired the startup Voyage during the first quarter of 2021 and announced a partnership in Dubai to roll out autonomous shuttles within the next years.

Cloud solutions with increased attention

Moving closer to deployments of autonomous driving setups, partnerships in the space of scalable cloud solutions are seeing more traction. OEMs like Volkswagen Group or General Motors announced partnerships with Microsoft to benefit from the performance of the Azure cloud solutions. Amazon Web Services, the cloud business unit at Amazon, has announced partnerships with Toyota, Mobileye, TuSimple and Blackberry QNX.

Autonomous trucking and delivery first

Some well-funded and leading stakeholders in the space of self-driving tech stacks are either shifting towards autonomous trucking and delivery first or adding it as a prominent vertical in addition to tech stacks for autonomous shuttles. Waymo launched Waymo Via, a self-driving solution for autonomous trucking and last mile delivery. In this space, the company is collaborating with UPS on the last mile logistics piece and with Daimler Trucks and others for long haul trucking.

Aurora, the company founded by Google, Tesla and Uber veterans, shifted to solutions for the trucking space as well. Recently, the company announced a partnership with the Volvo Group to deploy the Aurora tech stack on Volvos class 8 trucks. Aurora also took over the Uber ATG business unit, the deal also included an investment by Uber into Aurora.

Further players in this space with significant moves in the last month are Nuro, above-mentioned TuSimple or Embark.

Food and grocery delivery

When Amazon bought ZooX, one of the narratives told by media and experts to explain the deal, was a plan for a fleet of autonomous delivery vehicles to reduce the delivery costs. So far, this story has not materialized but other e-commerce and delivery services are filling the gap. Walmart, one of the strongest Amazon competitors in the US invested in Cruise and has multiple partnerships with Gatik, Nuro, Udelv and Ford to explore the spaces of autonomous delivery to customers and self-driving trucking as well. Fast Food chains like Chipotle or Domino’s Pizza and delivery platforms like DoorDash are also in the exploration phase of autonomous delivery. Chipotle was going the next step beyond partnering by investing in Nuro, one of the leading autonomous last mile delivery company.

About the map

The full map is available to download here. The document includes the force directed map with more than 200 companies and above 400 connections mapped, supplemented by deep dives into the partnerships of automotive OEMs and tech players. The study is also including an overview of interesting companies and organizations to watch. Multiple startups have not disclosed any partnerships so far, but are working on interesting solutions for the industry.

A five-layer logic is used to classify the companies and stakeholders depending on their solutions, ranging from self-driving systems to demand creation and entertainment. Each layer is broken down in up to 6 sub-segments for an even better transparency of the investigated space.

Do EVs excite your electrons? Do ebikes get your wheels spinning? Do self-driving cars get you all charged up?

Then you need the weekly SHIFT newsletter in your life. Click here to sign up.

Get the TNW newsletter

Get the most important tech news in your inbox each week.