Dutch semiconductor company NXP has teamed up with TSMC-backed Vanguard International Semiconductor (VIS) to build a $7.8bn (€7.2bn) chipmaking plant in Singapore.

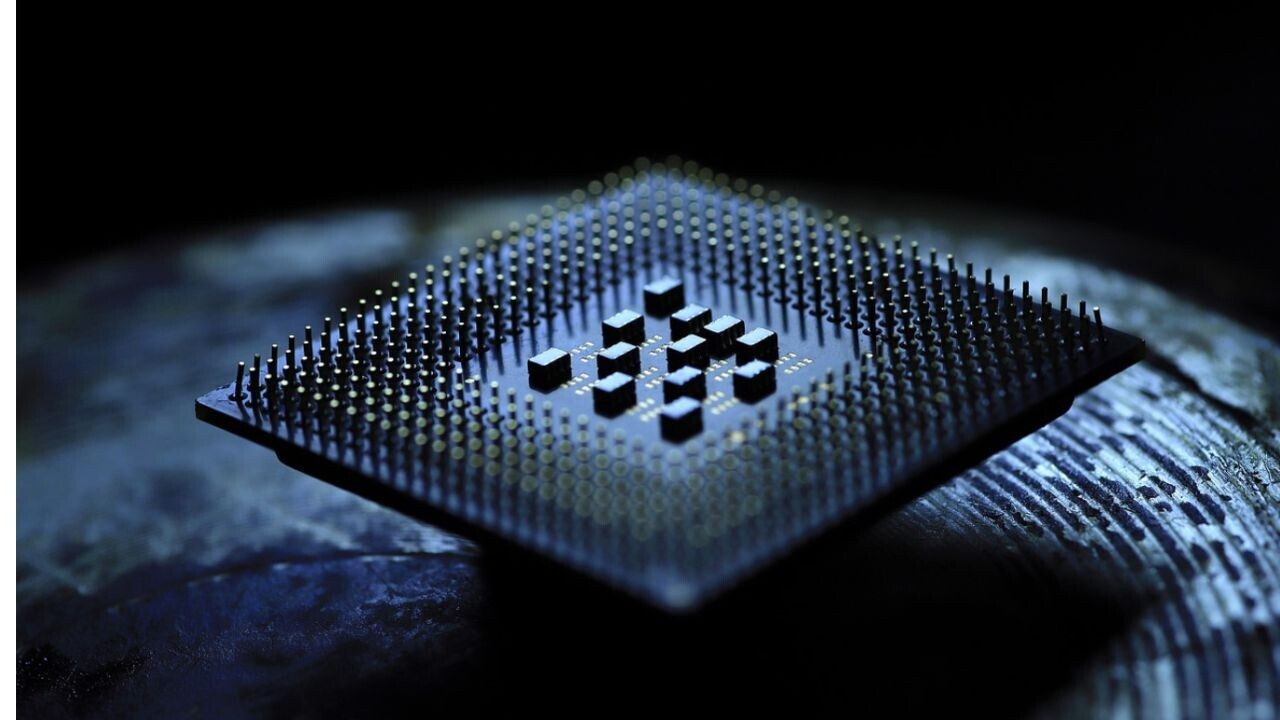

The new factory will make 300mm silicon wafers for 130-nanometre to 40-nanometre chips, which power applications in the industrial, automotive, consumer, and mobile markets.

These chips are less advanced than those TSMC itself manufactures in Taiwan. But the 300mn wafer capability marks a first for VIS, which currently fabricates 200mm wafers at its existing plant in Singapore. The larger size of the 300mn wafers enables the production of a higher number of chips.

Construction of the fab will begin in the second half of 2024, with initial production set for 2027. The two companies expect an output of 55,000 wafers per month in 2029.

As part of the joint venture, VIS will inject $2.4bn (€2.2bn) for a 60% equity stake. NXP will hold 40% equity, backing the project with $1.6bn (€1.5bn). The remaining funding will come from (unspecified) third parties.

“NXP continues to take proactive actions to ensure it has a manufacturing base which provides competitive cost, supply control, and geographic resilience to support our long-term growth objectives,” Kurt Sievers, NXP President and CEO, said in a statement.

Diversifying chip supply chains

Geographic resilience is key to ensuring diversified supply chains, especially amid an increasingly unstable geopolitical landscape.

US tensions with China, alongside fears of a potential Chinese invasion of Taiwan, have spurred concerns over the global chip production’s concentration in just a few countries.

Taiwan is one of them, making approximately 90% of the world’s most advanced chips. For its part, China dominates the market of lower-end semiconductors.

Against this backdrop, Southeast Asian countries have emerged as an attractive alternative for investment for both US and European chip makers. Germany’s Infineon, US-based Micron Technology, and NXP, through a previous partnership with TSMC, have already established their presence in Singapore.

Get the TNW newsletter

Get the most important tech news in your inbox each week.