We’re on the edge of a major social shift in mobility. Autonomous vehicles are going to change our lives. Commutes will be unrecognizable, cities will change, and industries reshaped.

We’re still a long way away from that — but companies are edging ever closer.

There are prime examples, both approaching the challenge in very different ways. The first is Tesla, with its beta-testing of Level 2 driver-assist tech that aims to progress to full vehicle automation.

The second is a group of companies involved in the development and deployment of autonomous robotaxis.

But how do they compare? And how do we get from here to a fully autonomous future?

If we look beyond the tech alone, two significant measures of success come to mind: partnerships and capacity for scale.

By partnerships, I mean industry collaborations that advance not only the number of vehicles, but the tech, as well as its accessibility to users.

Scale is also critical. We need a lot of cars on the road before vehicle automation is anywhere near hitting critical mass.

Let’s a look at how the two approaches face up against each other.

How do Tesla sales compare to the number of robotaxis on the road?

In 2021, Tesla reportedly produced and delivered over 930,000 electric cars worldwide.

If we look at the number of sales alone, that’s a mammoth army of Tesla owners.

And, spoiler: there is nowhere near that number of autonomous robotaxis on the roads – in testing or otherwise. So, if Tesla can successfully develop autonomous tech, they win the battle on private car ownership alone.

That’s a big “if” though, especially considering they’re only testing Level 2 vehicle automation.

So, could Tesla even get from cars to robotaxis?

Currently, Tesla’s driver-assist cannot be deployed without an initial safety score determined by monitoring user behavior over some time.

If the company’s goal is to go from driver-assist FSD to robotaxi, a lot needs to go right. Plus, there has to be a technological improvement — much of which current robotaxi makers are already deploying.

The reality is that no one knows how easy it will be to switch Tesla FSD beta testers into Level 3 and 4 autonomation, let alone full automation.

Last year Musk announced that the number of American FSD Beta vehicles went from a couple of thousand in Q3, to nearly 60,000 by the end of Q4 — a massive leap in anyone’s book.

By comparison, if we look at China, the adoption of FSD is surprisingly low. It sits at 1% to 2%, compared to an adoption of 20% to 25% in the US and Europe.

Tesla’s business model is deploying owners to test their software as it evolves, so they can iron out the bugs.

But these low adoption rates suggest there are a lot of people who don’t want to drive their car with driver-assist, let alone full automation. This makes it difficult to advance their driving tech in the real world. Especially when we compare it to the heavy lifting already done by companies like Argo, Cruise, and Waymo.

But Tesla’s gaining partners

Prior to the challenges of getting enough beta testers, Elon Musk predicted that Tesla will have their own robotaxis on the road by 2023. Can it succeed?

How long for the first robotaxi release/ deployment? 2023?

— Pranay Pathole (@PPathole) April 12, 2020

In 2021, the company sold over 100,000 Model 3 cars to Hertz. And in October of the same year, Hertz and Uber also announced a partnership to make up to 50,000 Teslas available by 2023 for Uber drivers to rent.

But does this translate to 100,000 robotaxis in the making? Hardly! They’re still beta testing Level 2!

Compare this to the groundwork existing robotaxi companies have put in.

Autonomous Robotaxi are deeply partners with the titans of industry

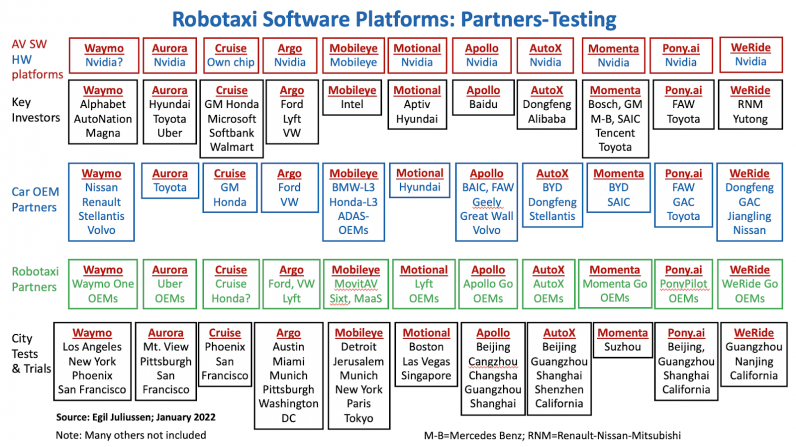

Robotaxi companies Baidu Apollo, AutoX, Pony.ai, WeRide, Didi, WeRide, Waymo, Argo, Aurora, and Cruise, are all partnering with various brands to develop the technology needed to get autonomous taxis on the road.

Cruise (majority-owned by GM) is currently deploying autonomous robotaxis in San Francisco. In 2021, Cruise CEO Dan Ammann announced a target for at least one million self-driving vehicles by 2030. This feels like a far more realistic and achievable aim than what Tesla has suggested.

There’s also the challenge of geographic expansion

It’s not all plain sailing. Let’s not forget how the legal status of autonomous vehicle technology differs wildly throughout different parts of the US. How easy will it be to get all states on board?

Currently, autonomous taxis only operate on pre-mapped streets. By comparison, Tesla FSD drivers can go anywhere.

We have no way to know if autonomous robotaxis will have mapped the whole of the US before Teslas are operating without human drivers.

Who’s in the best position?

If I was to place a bet, I think we’ll see more Teslas on the road than robotaxis.

But here’s the kicker: the Teslas won’t be autonomous. Maybe they’ll progress from Level 2, but I can’t see them going from Level 2 to 5 without a lot of challenges — especially in safety and regulatory approval.

So there we are. The robotaxi industry and Tesla have significant challenges scaling and evolving their tech. Furthermore, they all need to convince the public that they want to travel by autonomous vehicle — and this may be their biggest challenge of all.

Get the TNW newsletter

Get the most important tech news in your inbox each week.