Cryptocurrency analysts have warned that early adopting Bitcoin whales still have “plenty of clout” when it comes to dictating market prices.

Those behind Twitter-based transaction monitor @whale_alert have noted that an apparently dormant Bitcoin address houses almost 80,000 BTC ($750 million), and if the owner decides to sell them all, it could spell utter devastation for the industry.

“That address alone — if that is actually a whale who’s been holding their coins for so long without doing anything with them — if they decide, ‘Okay, let’s go sell them,’ it would crush the market completely,” Whale Alert told crypto prime dealer SFOX in a recent interview.

“But it’s really hard to say anything about the status of that address: Are those keys lost? Is that person even still alive? […] It’s just waiting to see if anything happens with those addresses,” they added.

A list of top dormant Bitcoin whale addresses (in which no outflowing Bitcoin has been detected in at least five years) can be found here.

The ‘Bitcoin whale effect’ has been demonstrated before

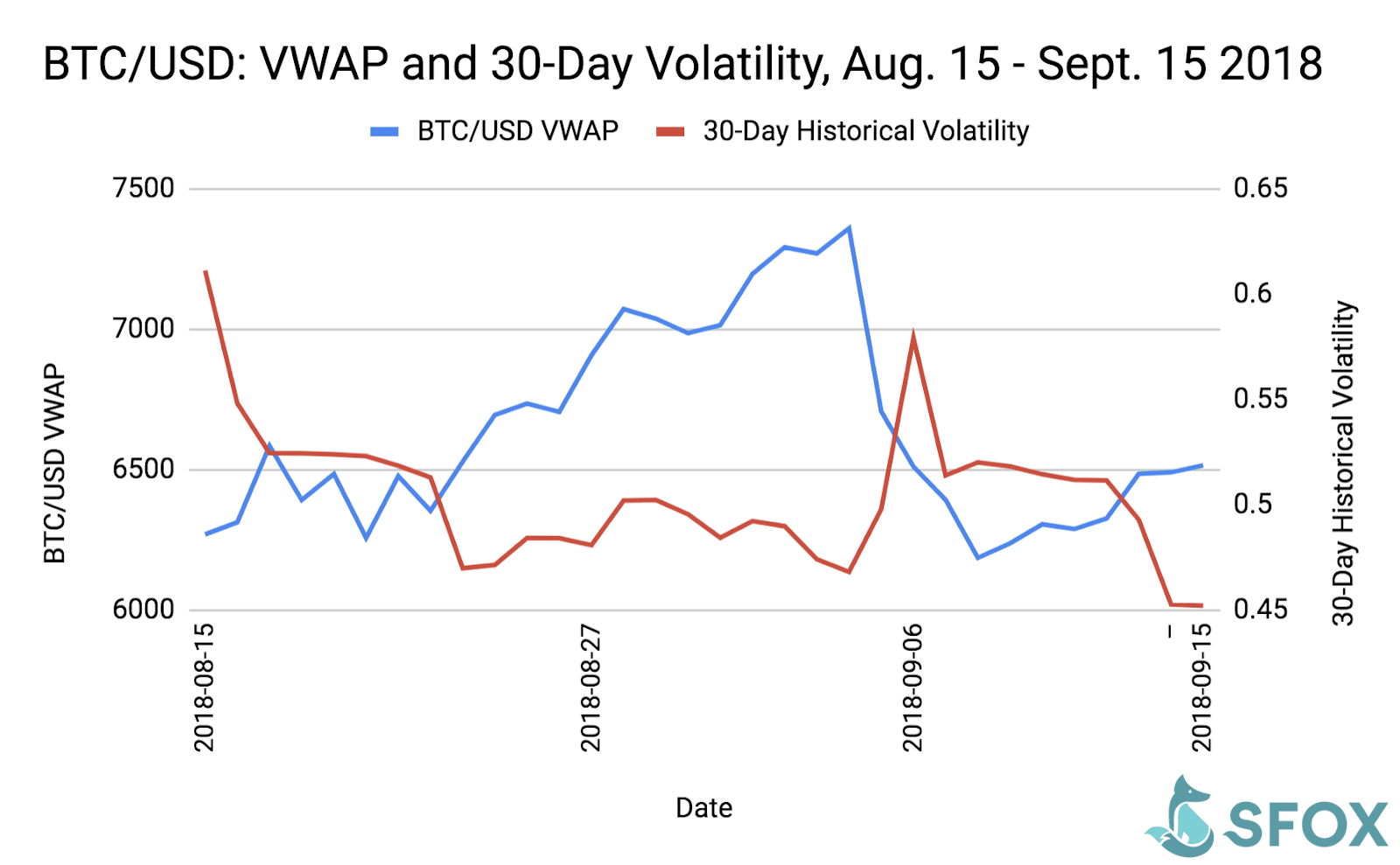

It’s plausible that the power of Bitcoin whales has been demonstrated recently. Whale Alert told SFOX that between August 29 and September 6 2018, a cryptocurrency whale unloaded around $1 billion worth of Bitcoin after they moved the funds from a single wallet to exchanges.

When most of the Bitcoin from the wallet was sold, the price of Bitcoin dramatically dropped by almost 15 percent, and the 30-day rolling volatility increased by almost 25 percent.

Another example is the recent closure of a darknet child abuse imagery ring in South Korea. Police confiscated a massive amount of Bitcoin from the perpetrators, which were eventually auctioned.

Whale Alert managed to track 10,000 BTC ($94 million) during the auction, which were likely sent to cryptocurrency exchange Binance for selling.

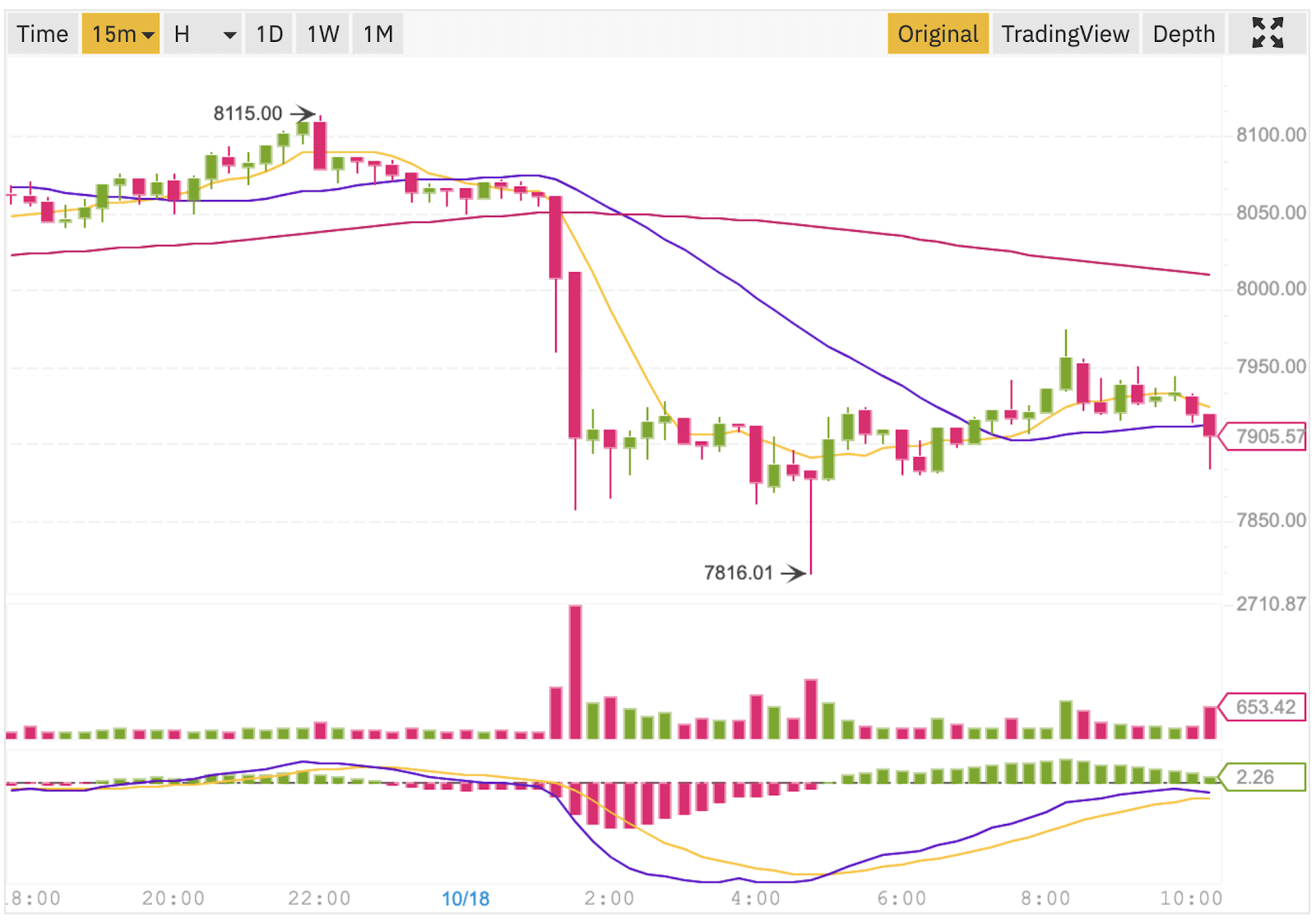

“Almost directly after that big transaction, the price of BTC dropped,” said Whale Alert. This seems to be corroborated by Binance’s order book, which shows a rise in volume just a few hours after the auction.

An eventual BTC selloff drove the price of Bitcoin on Binance from $8062.56 to $7856.89.

It’s worth noting, however, that these kinds of movements are often localized to one particular exchange – in this case, Binance.

However, when such large, inactive Bitcoin addresses exist, one can’t help but wonder what the markets would look like if dormant whales one day awoke with a sudden urge to capitulate.

You can read the rest of the Whale Alert interview here.

Get the TNW newsletter

Get the most important tech news in your inbox each week.