This ball-busting bear market has lasted almost a full year. No better time to check on how the circulating supply of Bitcoin is currently distributed.

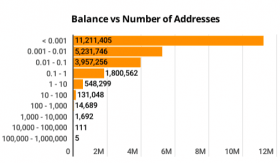

Recent analysis run by digital asset research firm Delphi found 22.9 million Bitcoin addresses currently hold some Bitcoin (as in, more than none).

Uncomfortably, nearly half contain less than 0.001 BTC ($3.40), and almost 90 percent hold less than one-tenth of a BTC ($340).

At this stage, the “#HODLgang” seems to be more of a “#HODLskeletoncrew.”

Most holders can’t afford to buy Beats with their Bitcoin

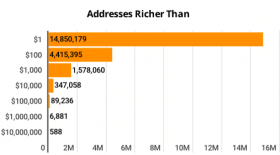

A sobering statistic is that just 20 percent of Bitcoin addresses contain more than $100 worth of BTC.

Yes, that means 80 percent of Bitcoin addresses own less BTC than it takes to buy a pair of mid-range headphones.

While there certainly are more than 1.5 million Bitcoin addresses with over $1,000 in BTC, these holders account for less than 7 percent of all Bitcoin addresses.

By comparison, there are only 588 addresses that house more than $10 million worth of BTC.

For reference, this is less than the maximum capacity of a Boeing 747, meaning we could totally fit Bitcoin’s richest onto a single airplane, right now.

Bitcoin’s middle class control more BTC than anyone else

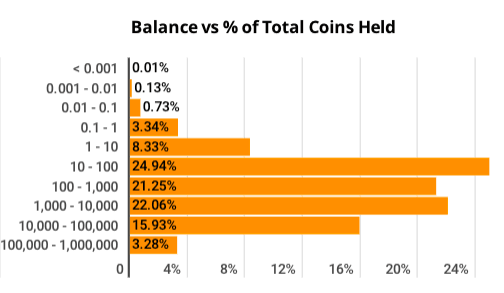

Delphi further analyzed balances of Bitcoin addresses in groups. This gives us insight into the percentage of Bitcoin supply controlled by each slice of the market.

Presently, addresses containing between 10 and 100 BTC ($34K – $340K) own 25 percent of the circulating Bitcoin.

The very top group are the Bitcoin addresses with balances ranging from 100,000 BTC to 1,000,000 BTC ($341M – $3.4B).

Curiously, these addresses control barely more three percent of the total BTC supply.

Bitcoin whales may have shrunk in the wash

This data indeed corroborates previous research, which revealed more than half of Bitcoin’s circulating supply was being controlled by wallets with balances over 200 BTC.

At the time, those addresses were worth a cool $1.25 million. Now, they amount to just $680,000 each.

Back then, Hard Fork described these holders as Bitcoin’s 1-percenters.

Now, I suppose it’s more fitting to refer to them as Bitcoin’s half-a-percenters.

Get the TNW newsletter

Get the most important tech news in your inbox each week.