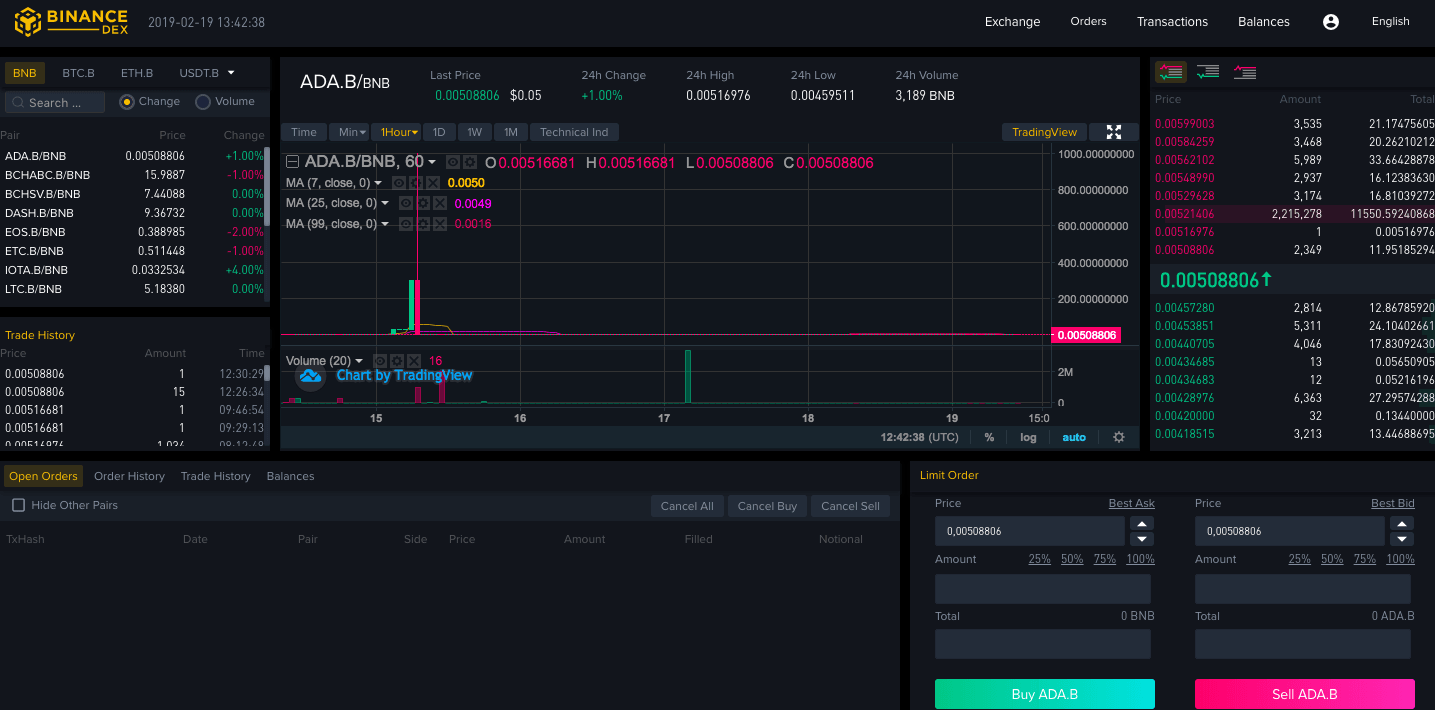

Following months of anticipation and numerous teasers, Binance has finally launched its decentralized cryptocurrency exchange (DEX) powered by its own blockchain, Binance Chain.

But hold your horses before you get too excited: Binance DEX is only rolling out to a dedicated testnet for the time being. Still, users will now be able to try out the new trading platform. Among other things, traders can create a wallet and exchange tokens.

“Binance DEX is a decentralized exchange with a decentralized network of nodes, where you hold your own private keys and manage your own wallet,” said Binance CEO Changpeng Zhao. “With Binance DEX, we provide a different balance of security, freedom and ease-of-use, where you take more responsibility and are in more control of personal assets.”

Unlike Binance’s flagship cryptocurrency exchange service which holds users’ private keys for them, the new DEX will allow traders to store their private keys independently. This means users will retain ownership of their coins, even if the exchange gets hacked.

Indeed, Zhao said the DEX service already supports Binance’s recently acquired standalone wallet, and can additionally be paired with more secure hardware storage solutions like the Ledger Nano S.

The downside is you can no longer count on Binance to reset your password if you lose your credentials, but hey, that’s the price of decentralization.

Those interested can give the Binance DEX a test drive by clicking here. For a more technical overview, you can find the Binance Chain blockchain explorer here or look up its documentation on Github here.

Moving away from Ethereum

Much like a swath of other blockchain companies which ran initial coin offerings (ICO) on the Ethereum network, Binance still uses the ERC20 standard for its own BNB token. This could soon change, though, as the company gears up to make BNB the native asset in the new DEX platform.

In this sense, the launch of the DEX represents Binance’s first major step towards migrating away from the Ethereum network and towards its own blockchain.

“Binance Chain has near-instant transaction finality, with one-second block times. This is faster than other blockchains today,” Zhao said about the new DEX. “With the core Binance Chain technology, Binance DEX can handle the same trading volume as Binance.com is handling today. This solves the issues many other decentralized exchanges face with speed and power.”

In a recent Q&A session, Zhao said Binance Chain is based on the Tendermint protocol and runs on a Delegated-Proof-of-Stake (DPoS) consensus algorithm.

Currently, Binance claims its blockchain can handle a throughput of “a couple of thousand” transactions per second. For contrast, Ethereum currently handles about 15 transactions per second, and Bitcoin – about seven.

Is the Binance DEX really decentralized?

Despite the buzz around the new DEX service, Binance’s claims of “decentralization” have already attracted critics on social media.

For starters, Binance Chain will likely launch with 11 network validators responsible for processing transactions. While Zhao has suggested Binance will allow for more validators in the near future, the company will remain selective about choosing them for the time being.

Although running on a number of pre-approved nodes means Binance Chain will be capable of processing large transaction volumes on its network, this model puts its network in the same category as permissioned blockchains, which are often associated with higher degrees of centralization.

Among others, Ethereum co-founder Vitalik Buterin recently unleashed a scathing critique against permissioned blockchains, calling such implementations “centralized piles of thrash.”

“When a blockchain project claims ‘We can do 3,500 transactions per second because we have a different algorithm,’ what we really mean is ‘We are a centralized pile of trash because we only have seven nodes running the entire thing,’” Buterin said.

Still though, it’ll be interesting to see what direction Binance takes with its DEX service – and how long it takes before it reaches the decentralization levels it has been boasting about for so long.

Get the TNW newsletter

Get the most important tech news in your inbox each week.