Pump-and-dump schemes are some of the oldest and sketchiest scams used in the financial sector, and sadly, the cryptocurrency industry has seen its fair share.

There is an ever-growing list of coins whose values are artificially inflated, only for early buyers to sell off at a pre-arranged peak price. Less informed investors often fall foul thinking increased interest in the coin is a sign of long-term growth – only it isn’t. This helps to drive the price up even further, but sadly the outsiders don’t know to sell, and end up losing out when the price tanks.

Spotting a pump-and-dump is tough work, but academics from Imperial College London have devised a protocol, using machine learning, to predict the illicit schemes.

Jiahua Xu and Benjamin Livshits analyzed the message history of over 300 Telegram channels between July and November 2018, in doing so, the academics identified 220 individual “pump events” organized through the messaging platform. From this analysis, a model was developed that can predict the likelihood of a coin being pumped, before it is actually pumped.

The researchers uncovered an alarmingly high number of pump-and-dump schemes. Xu and Livshits state that there are over 100 Telegram channels dedicated to the pumping and dumping of lesser known coins, these channels organize these events twice a day, on average. The researchers estimate this contributes $7 million of artificial trading volume to the cryptocurrency market each month – that’s $84 million per year.

The anatomy of a pump-and-dump

The academics focused on an individual coin that was pumped through the infamous “Official McAfee Pump Signals” Telegram channel – which has over 12,000 members – to devise the key characteristics of a pump-and-dump scheme.

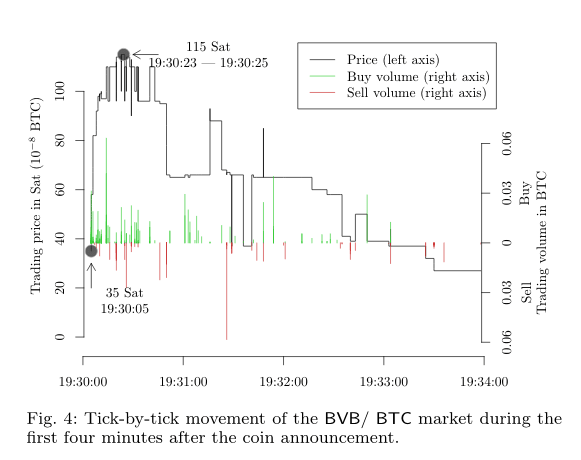

On November 14, 2018, an announcement was made stating that the target coin would be the BVB, a coin supposedly setup by supporters of Borussia Dortmund football club. For all intents and purpose, this was a dead coin and, as the paper states, has not been active since late 2016.

After the announcement people started buying the coin at around 35 satoshis ($0.0014) until it peaked at 115 satoshis ($0.0045). Just three and a half minutes after the announcement, the coin was trading at less than its opening price. With most participants buying and selling the coin in that time period.

Indeed, the low coin values here might make it seem irrelevant, but consider again that these activities are adding up to over $7 million in transaction volumes, per month. Clearly, there are a lot of pump-and-dumps schemes taking place.

The researchers took this concept and used it to identify 358 Telegram channels specifically focused on artificially bloating the prices of small time coins.

The analysis

Xu and Livshits then analyzed the market data – such as market cap, price, trading volume, and so on – of some 236 coins that were announced as “pump targets” in these Telegram channels. The analysis was conducted between July and November 2018.

From analyzing the historical data of these coins, the researchers were able to identify a few key characteristics that were then used to coach a machine learning algorithm to spot pumps before they happen. Quite simply, the algorithm is looking for any unusual and untimely trading activity in small time coins.

After the algorithm had been taught what to look out for, it was unleashed on the world. In the week between October 30 and November 6, 2018 it found six instances of suspicious “pump-and-dump” like activity, it was correct on five of these cases.

Of course, a much longer and broader application of this algorithm needs to be used to truly understand its power. This study only focused on four cryptocurrency exchanges, as such there is the possibility that the trading characteristics on other exchanges might not fit the model.

For good or evil?

This paper creates a bit of a moral dilemma. Xu and Livshits claim their algorithm has a high level of accuracy, so much so, that it can be used to inform an investment strategy that can deliver an 80-percent return in just three weeks.

While this might demonstrate the power of the algorithm and machine learning, I certainly hope that this system will be used for good and not evil. Hard Fork reached out to the researchers to ask if there were any plans to develop this algorithm for commercial applications – we’ll update this piece as we learn more.

It seems that it could easily be used to warn investors of coins that are showing signs of market manipulation, rather than telling them when to buy and when to sell. If that is the case, the days of the pump-and-dump scheme could be numbered.

This isn’t the first time research like this has been conducted, scholars from the University of Florida and Princeton studied pump-and-dump schemes earlier this year, finding that they are indeed, bad.

Get the TNW newsletter

Get the most important tech news in your inbox each week.