2018 was a wild ride for cryptocurrencies. Despite the many ups and downs experienced by Bitcoin and other major cryptocurrency vendors, the market has proven that it is going to stick around for the long haul.

Though there is still risk involved in cryptocurrency, investors are coming to better understand the challenges and opportunities associated with this exciting sector. As a result, more people are entering the crypto trading sphere than ever before.

If you’re still new to the crypto investing scene, however, the sheer number of investing options — and new terminology — can feel overwhelming. By taking steps to better understand what you’re getting into, you will make wiser investment decisions.

Here are some tips to get you started on the right track:

1) Know the relation between market cap and circulating supply

New cryptocurrency investors may be intimidated by the new vocabulary they need to learn and how these different terms affect pricing. For example, the “market cap” for a particular coin is used to determine the total value of coins on the market. This number is determined by multiplying the coin’s circulating supply by its current price.

The use of the circulating supply, rather than the total supply, is an important distinction. For a variety of reasons, some coins are not available on the public market. Because they aren’t available for trading, they are not counted toward price considerations or the market cap.

2) Keep up with current market conditions

You can read articles debating the pros and cons of various cryptocurrencies, but current market data will always be the most reliable source for identifying trends and making smarter trading decisions.

Fortunately, there are several websites dedicated to providing up-to-the-minute updates regarding changes in price, supply and market cap. Coincap, CoinMarketCap, and CryptoCompare are just a few examples of resources that help investors stay up to date on current prices. Data that is updated in real-time is paired with charts tracking changes over 24-hour and seven-day periods to give investors a better idea of current trends.

3) Follow the leaders

Even when you have real-time data available, making a trading decision based on a “top 100 cryptocurrencies” list can be intimidating.

However, when this data is paired with guidance from top investors, you can have greater confidence in your decisions and even learn a few extra pointers along the way.

Sites like eToro utilize what is known as a “social trading” program that allows top investors to share their knowledge and trading practices.

New investors can use these traders as a guiding reference or even fully match their investment strategies as they learn the ropes. Picking up good habits early on in your investing journey will keep you from making the impulsive decisions that can lead to disaster.

4) Diversification is vital for success

As with traditional investment opportunities, diversification is essential if you wish to come out a financial winner in cryptocurrencies. With a more diversified portfolio, you reduce your overall risk, especially if you invest in coins and tokens that service different sectors.

This also means you should continue to invest in non-crypto spheres. These practices maximize your potential return while alleviating the risk should a particular coin or stock go under.

You can keep your coins organized and protected with a cryptocurrency wallet. These digital wallets serve as a centralized hub for receiving and sending crypto transactions. Keeping your diversified investments locked in a secure wallet will make it easier to keep track of your investments.

5) Understand which factors influence pricing

What causes cryptocurrency prices to rise and fall? Though supply and demand certainly play a role, crypto investors should carefully consider the perceived utility of a cryptocurrency. If a coin is perceived as having several practical applications, it will be more highly sought-after, and therefore, increase in price.

As MyCryptopedia explains, mining difficulty is another major factor that affects pricing: “A higher mining difficulty means that it is harder to mine an additional unit of a coin. This can have an impact on a coin’s perceived value, and subsequently, its price, as increasing a coin’s supply will require more computing power to be used in the mining process.”

Savvy investors should also pay attention to news headlines regarding different coins and tokens. Positive or negative articles will often have a direct correlation on future pricing trends.

6) Research individual coins and tokens

Cryptocurrencies have frequently been called out as nothing more than a scam by skeptical individuals. While many crypto products have proven themselves to be worthwhile investments, other tokens and coins have indeed been scams, some of which have cost investors millions of dollars.

While this isn’t much of a risk with any of the major, better-known cryptocurrencies, anyone considering investing in a new coin or token should do thorough research before making a trade.

By understanding how a coin will operate within the market, you can determine whether or not it is a legitimate opportunity — and if it is legitimate, you can likely identify whether it will actually be a good investment.

In addition to researching market news, resources like All Crypto Whitepapers can greatly assist your investigative efforts. This site collects all documents highlighting cryptocurrencies’ technical details, marketing plans and more so you can better understand what they have to offer.

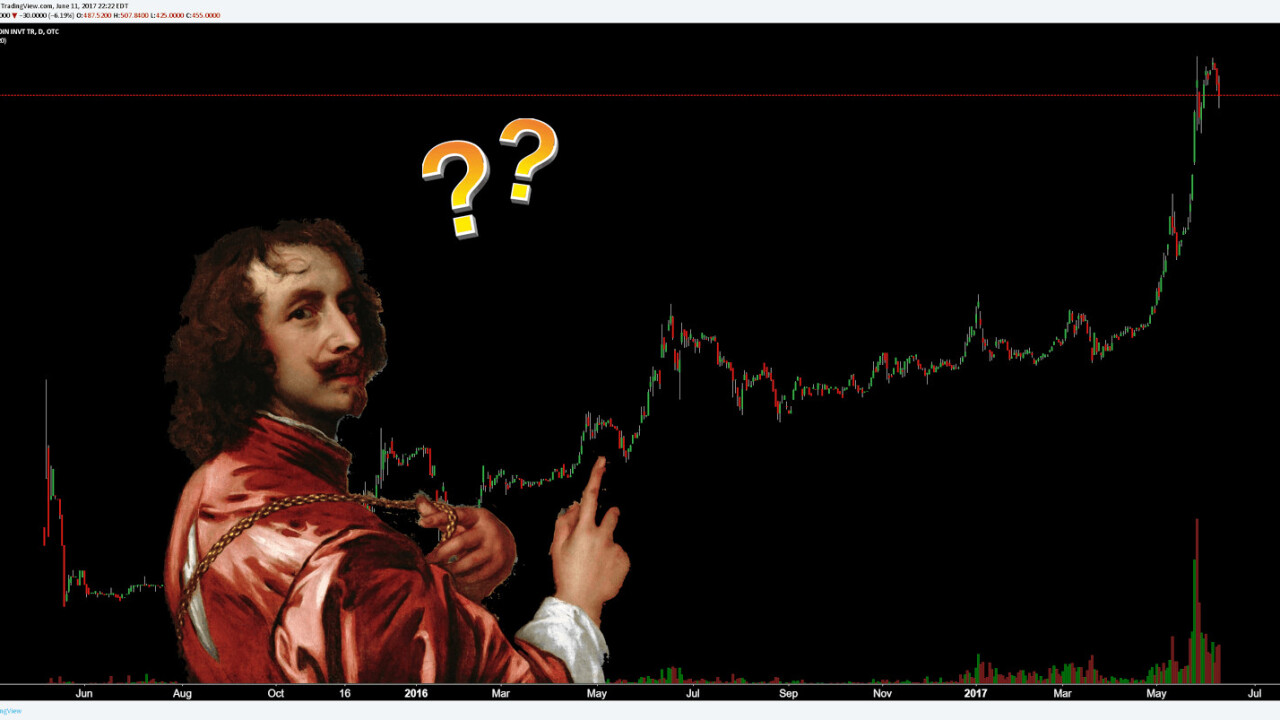

7) Prepare for volatility

No one can predict what the market will do with 100 percent accuracy — and this is perhaps truer of cryptocurrency than any other investment sector. Panicking over day to day changes in the market value won’t do you much good. You’re more likely to rush into an impulsive decision and make a trade you’ll later regret.

The stock market provides valuable lessons for handling this volatility, as global stock markets are no stranger to sudden rises and falls in pricing. As such, many traditional lessons and tips for handling volatility are just as applicable to crypto investors.

Many of these practices highlight the value of long-term investments by focusing on a future reward rather than daily price fluctuations. Even short-term investors need to exercise a bit of patience and look at the bigger picture. Understanding that volatility is part of crypto investing, but that you should still experience great growth in the long run, will help you make wiser decisions.

Cryptocurrency trading is expected to increase by 50 percent in 2019 alone.

Despite the seemingly never-ending claims that crypto is a “fad” or already dead, it is clear that this investment option is here to stay. By becoming an informed investor now, you can stay ahead of the curve and be better prepared for future market shifts.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Past performance is not an indication of future results. This is not investment advice. Your capital is at risk.